May Kay Which Tax Forms Do I Use to File

Because you earned money the IRS will not regard this as a hobby. If you did not claim the federal child tax credit earned income tax credit or federal childdependent care credit you do not need to amend your return and you are not eligible for an enhanced Alabama.

How Filing Tax Amendments Works Howstuffworks

Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

. Depending on your state you may. Form 5472 is an information return for tax purposes and after an LLC is liquidated it must file a final Form 5472 as well as when adding membersI am a Mary Kay Beauty consultant. _____Other Income1099-misc from Mary Kayommissions promotions prizes awards car program.

You can also obtain a federal tax ID as a MARY KAY sole proprietor and use it as a business tax ID in the place of a social security number. Subsequently question is how much discount do Mary Kay consultants get. Start filing for free online now.

Mary Kay will send you a Form 1099-MISC which they also file with the IRS so the IRS knows. What Forms Do I Need To File My Missouri State Taxes. The following is a list of suggested steps you may take to help you prepare your income tax return.

Download Schedule C from the IRS. Or if you keep and report inventory on your taxes it could be included in your inventory amounts. What to know about Admissions Tax.

You can find it on InTouch by hovering over the resources tab and selecting tax. Call it the Mary Kay Tax. Answer 1 of 2.

However you will still need other registrations such as licenses an assumed business name DBA and tax IDs as described above. What if my sales are reported through the company whose products I sell Mary Kay Scentsy etc. To find it go to the AppStore and type signNow in the search field.

You are a business that uses a DBA doing business as trade name to trade that is other than the full legal first and last -- full name name of a sole proprietor or a name other than the LLC or Corporation business name need an assumed business name certificate. If you earn less than 600 in a tax year Mary Kay does not have to send you a Form 1099-MISC but as a business owner consultants must report their income to the Internal Revenue Service using Schedule C. Income Tax Deductions for Your Mary Kay Business.

Mary Kay Income and Expense Worksheet Income. Those you do not need to file a Missouri income tax return must file a Property Tax Credit Claim in order to receive a credit. However we do recommend but dont require you.

To apply for a refund simply request a form titled Sales Tax Refund Claim Form from your branch or you may obtain a form through Mary Kay InTouch. You can file Form 1040X through the HR Block online and software tax preparation products or by going to your local HR Block office. The Mary Kay tax department has assembled a great deal of information to help you navigate your tax filings.

How you file taxes on your Mary Kay business depends on whether your activities constitute self-employment or hobby income. Below you can get an idea about how to edit and complete a Mary kay tax worksheet 2019 step by step. To use this spreadsheet you must have your completed 2021 Federal 10401040-SR1040NR and all schedules forms and worksheets used to calculate your federal income tax.

For instance if you need to file a Missouri income tax return and you are eligible for a credit or refund you should utilize the Form MO-1040 and the Form MO-PTS. I sell make up skin care products and accessories. Mary Kay sales tax collection on business taxes.

Here you would be transferred into a splashboard allowing you to conduct edits on the document. Its a tax program the Legislature passed in 2009 to help balance the budget. Over 85 million taxes filed with TaxAct.

_____Total SalesAll income from lasses facials reorders dovetail etcuse your sales slips total including taxWe want to know how much money you actually received. These are only suggestions and each consultant should clarify with her personal accountant. Then it was signed into law by then-Gov.

If you choose to form a corporation or LLC then you will need to get an EIN. Push theGet Form Button below. Yes the sales tax would be a deduction as Cost of Goods Sold if it is product you later sold to a customer.

The hobby rules are invoked when you lose money and then only if there are other circumstances see below. How do you apply for a Retail License. It hits small businesses such as Mary Kay and Avon distributors with heavy administrative costs while bringing a pittance to the state treasury.

Printable mary kay order formS device like an iPhone or iPad easily create electronic signatures for signing a mary kay tax worksheet 2021 in PDF format. Personal Use Product Your Cost - Unseen - Physically Can Not See Closing Inventory At Your Cost Advertising PCP PINK etc Insurance on Mary Kay Product Interest on Loan or Credit Card Dry Cleaning Legal and Professional Office or Bookkeeping Expenses Weekly Meeting Fees Supplies Sales Tax Paid From Packing Slips Travel Expenses. An Mary Kay business doing business under an assumed business name in Placer County ie.

Remit this form signed along with copies of your retail sales tickets to your branch. Or you may deduct this non-recovered portion of sales tax on your Federal Income Tax Return Schedule C. Also the entire amount received by your customer including sales.

How to file and pay Sales Use Tax and any applicable local taxes. Do I Need a Federal Tax Id Number to Sell Mary Kay. SignNow has paid close attention to iOS users and developed an application just for them.

Self-employed consultants must file Schedule C of form 1040 whereas hobby income is reported on line 8 of Form 1040 with expenses not able to be deducted at this time. What to know when applying for an Admissions Tax License. June 4 2019 545 PM.

Additional fees may apply. All corporations need an EIN because all corporations must file at least one separate return with the IRS Form 1120 or. A Useful Guide to Editing The Mary kay tax worksheet 2019.

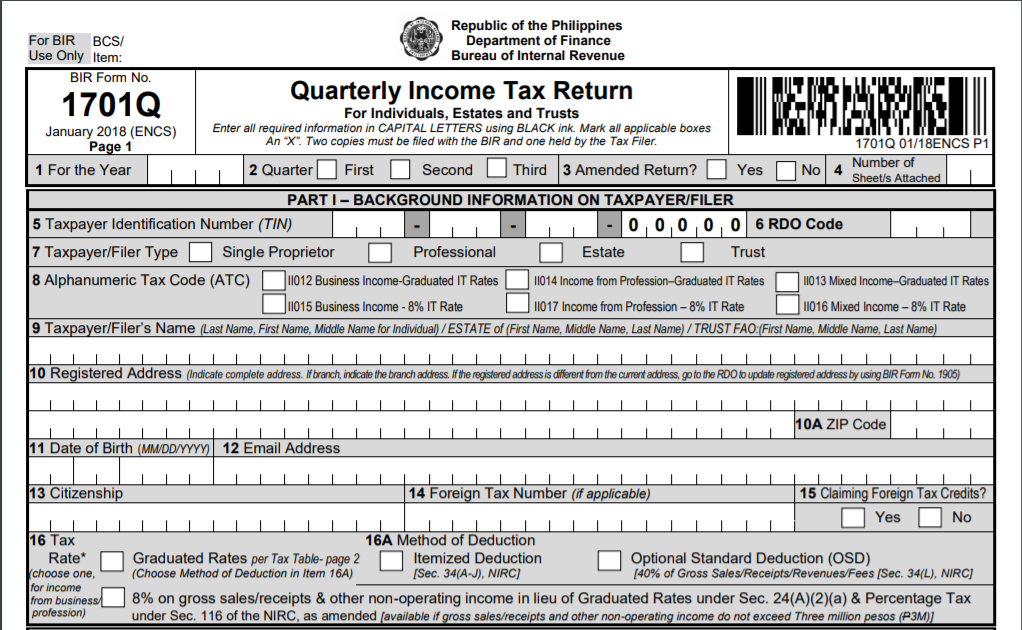

How To File Bir Form 1701q A Complete Guide For 2021

Tax Filing Season 2016 Should Start On Time Jan 19 2016 Date Looks Doable Thanks To Congressional Action On Extenders Don T Mess With Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

Tax Season Begins January 24 What You Need To Know

Printable Tax Checklists Tax Checklist Tax Printables Small Business Tax

Fillable Form 1040 Individual Income Tax Return Income Tax Income Tax Return Tax Return

Customer Testimonial Expressextension Tax Extension Customer Testimonials Previous Year

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

Made A Tax Return Mistake Fix It By X Filing An Amended Return Don T Mess With Taxes

Turning In U S Tax Cheats And Getting Paid For It Don T Mess With Taxes

5 Mailing Or Delivery Service Tips For Paper Tax Return Filers Don T Mess With Taxes

When Is The Earliest I Can File My Taxes The Motley Fool

Form 1040 U S Individual Tax Return Definition Income Tax Return Irs Tax Forms Tax Forms

Video Tutorials Income Tax Return Filing Federal Board Of Revenue Government Of Pakistan

How To File Previous Year Taxes Online Priortax Online Taxes Previous Year Tax

Income Tax Forms For Ay 2021 22 Income Tax Return Filing For 2020 21 Last Date Latest Update Youtube

Form 1040 Sr U S Tax Return For Seniors Definition Tax Forms Irs Tax Forms Ways To Get Money

Form 1040 X Now Can Be E Filed But Just For Now To Correct 2019 Return Mistakes Don T Mess With Taxes

Ofw Tax Are Ofws Required To File Income Tax Returns

How To Declare Taxes As An Independent Consultant Sapling Jamberry Business Thirty One Business Independent Consultant

Comments

Post a Comment